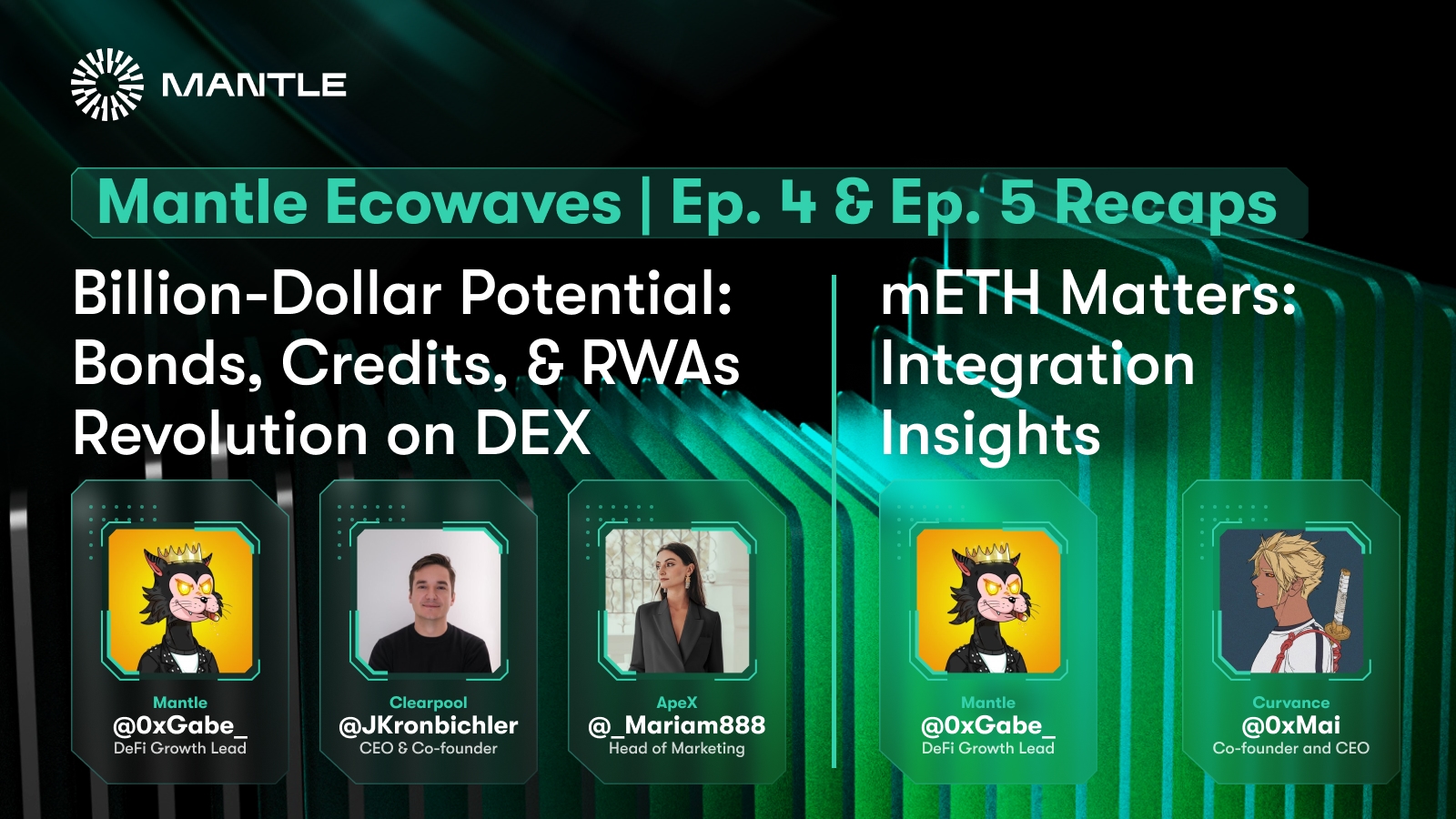

Mantle Ecowaves Ep. 4 - Billion Dollar Potential: Bonds, Credits, & RWAs Revolution on DEX

As the tokenization of real world assets (RWAs) narrative continues to gather pace, Gabe (@0xGabe_) hosted Ecowaves Ep. 4 with Jacob (@JKronbichler), CEO and Co-Founder of Clearpool, and Mariam (@_Mariam888), Head of Marketing for ApeX.

They shared insightful information on the RWA sector, discussing its progression so far and its future potential. If you're a DeFi enthusiast, you don't want to miss this one. Here's a recap of what was discussed.

Can you explain the process of tokenizing traditional financial assets like bonds and credit on the blockchain?

J: Tokenization is a way of representing traditional assets, like bonds or loans, as digital assets or tokens on a blockchain. All the contractual rights and terms, such as the amount to be paid, the timeline, and other details, are coded onto the blockchain. This process allows the blockchain to replace traditional legal agreements, leading to increased efficiency through automated execution. This eliminates the need for intermediaries who handle paperwork and ensure everything is in order.

The advantages of tokenization include higher liquidity, efficiency gains, and transparency, as everything is recorded on the blockchain. This is particularly important for loans. Additionally, tokenization improves accessibility. In the traditional financial system, assets like bonds and private credit are typically accessible only to a limited number of people, often large institutional buyers. By using blockchain, you open up these opportunities to a broader audience.

What does the regulatory landscape look like in the DeFi space right now?

J: The regulatory landscape for DeFi projects isn't clear, so the best thing blockchain projects can do is strive for compliance. At Clearpool, we actively work to be as compliant as possible with industry standards, which is our approach to navigating this uncertainty.

M: I agree with Jacob's statement about staying as compliant as possible until we gain regulatory clarity. I believe regulatory bodies will eventually show interest in tokenizing RWAs, because blockchain solutions can bring significant benefits such as transparency, reduced fraud, and enhanced regulatory compliance in financial markets. Governments will likely explore using blockchain technology to issue digital currencies and facilitate trading government bonds and securities. There's a lot of room for regulatory bodies and governments to become more interested in this space, leading to more cooperation in creating legal frameworks and standardization.

What innovations or advancements in the RWA space would you like to see?

M: I think a tokenized stock market on a DEX would be excellent. If traditional stocks are represented as digital tokens on a blockchain, it could really change the game. It would offer global accessibility and 24/7 trading. As Jacob mentioned, fractional shares would enable broader investor participation, allowing users to trade fractional shares of stocks with very low fees compared to traditional stock exchanges. Additionally, users would retain custody of their assets, which are usually held by centralized custodians such as brokerage firms in traditional stock trading.

Mantle Ecowaves Ep. 5 - mETH Matters: Integration Insights

With the launch of Curvance on the horizon, Gabe (@0xGabe_) was joined by Chris (@0xMai), Co-founder and CEO of Curvance, to discuss Curvance protocol and all the features Mantle users can take advantage of. Chris also gave listeners a glimpse of some exciting features coming to Curvance. Here's a recap of what was discussed.

What was the rationale behind creating Curvance, and what problems were you aiming to solve?

C: We are DeFi users ourselves, so we've experienced many of the problems firsthand. We noticed a lot of fragmentation and a lack of capital efficiency in the space. Our goal was to build an application that we would want to use, one that helps alleviate these issues.

There's been a lot of discussion at the Ethereum Foundation about fragmentation as more layer 2s come online. We see ourselves as the highway system for liquidity, connecting different chains and integrating them into a broader collective.

Can you describe some potential yield opportunities or strategies for a yield-bearing token like $mETH? What strategies are you considering?

C: I think liquid restaking and points farming will be heavily used. Another exciting aspect is our integration of Pendle PTs and Pendle LPs directly into the platform, allowing people to use them directly. Additionally, leveraged LP yield farming is a promising strategy. Many people will use Curvance to leverage up those positions, as there hasn't been a good platform for that until now.

How do you approach security and risk management for Curvance, considering that security is a major concern for users of money markets?

C: We've had to be very methodical and intentional with how we've built Curvance and made it tamper-proof. As you mentioned, the two things that get hacked the most are bridges and lending protocols. Since we're a lending protocol with bridging, that puts a big bullseye on our back. We've been auditing our protocol since August 2023 and are on our sixth audit. During these audits, we've received a lot of feedback and worked to fix mistakes and polish our solutions. This has put us in a great position to provide a robust service to our users.

What expected impacts do you anticipate having on Mantle's DeFi ecosystem?

C: I think the primary impact we can have is around discoverability. You guys have done a great job building the foundation for opportunities, but the biggest issue in crypto is discoverability. There are opportunities everywhere, and it's hard to find the signal amid the noise. One thing Curvance does well is showing users all available opportunities in one place.

A good example is our upcoming recommendation system, which won't be in the testnet but hopefully will be in the beta. This system will suggest opportunities on other chains if they offer a significant advantage over the user's current position, helping users find the best opportunities available.

Can you give us some more information about Curvance’s token, $CVE?

C: It's natively omni-chain, like many assets are nowadays, but it has some unique characteristics. For example, you can vote escrow with the token for the gauge system, which is also omni-chain. This means you can have your veCVE locked on Ethereum and vote for a particular asset on Mantle, or vice versa. You can vote from any chain to any chain, which makes it easier for users.

If you missed either of these episodes of Ecowaves, you can catch their entire recordings here:

- Mantle Ecowaves Ep. 4 - Billion Dollar Potential: Bonds, Credits, & RWAs Revolution on DEX

- Mantle Ecowaves Ep. 5 - mETH Matters: Integration Insights

While you’re there, remember to follow Mantle on X/Twitter to stay up to date with all the latest ecosystem updates.